See This Report about Hard Money Atlanta

Wiki Article

8 Easy Facts About Hard Money Atlanta Described

Table of ContentsThe smart Trick of Hard Money Atlanta That Nobody is DiscussingMore About Hard Money AtlantaNot known Details About Hard Money Atlanta The Buzz on Hard Money AtlantaAll About Hard Money Atlanta

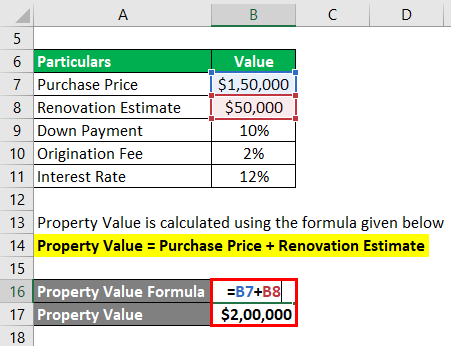

A specific funding buffer is still needed. Tough money financings, sometimes referred to as bridge loans, are short-term loaning instruments that real estate financiers can use to finance a financial investment task. This kind of financing is typically a device for home fins or realty developers whose objective is to refurbish or create a residential property, then offer it for an earnings. There are 2 main disadvantages to take into consideration: Difficult money car loans are practical, yet investors pay a cost for obtaining in this manner. The rate can be approximately 10 portion factors greater than for a traditional finance. Origination charges, loan-servicing costs, and shutting expenses are also most likely to cost financiers much more.

All About Hard Money Atlanta

You might have the ability to customize the payment timetable to your requirements or get certain charges, such as the origination charge, minimized or removed during the underwriting process. With a difficult money loan, the residential property itself typically serves as security for the finance. Once again, lenders might allow investors a bit of flexibility below.

Hard cash finances are a good fit for well-off financiers who require to get financing for an investment home quickly, without any of the red tape that supports financial institution financing (hard money atlanta). When examining hard cash lending institutions, pay close interest to the costs, rates of interest, as well as funding terms. If you wind up paying excessive for a tough cash loan or cut the repayment period too brief, that can influence exactly how successful your realty endeavor is in the lengthy run.

If you're wanting to purchase a house to flip or as a rental residential or commercial property, it can be challenging to obtain a typical home loan - hard money atlanta. If your credit history isn't where a traditional lending institution would like it or you need cash faster than a lender is able to supply it, you might be unfortunate.

Hard Money Atlanta Things To Know Before You Get This

Tough cash car loans are short-term protected lendings that utilize the property you're purchasing as collateral. You will not discover one from your financial institution: Hard cash loans are offered by different lenders such as private capitalists as well as private firms, who commonly ignore average credit report as well as various other economic factors and rather base their decision on the property to be collateralized.Difficult money lendings supply numerous benefits for consumers. These include: Throughout, a hard cash loan could take simply a couple of days. Why? Hard cash loan providers often tend to position more weight on the worth of a residential property utilized as security than on a customer's financial resources. That's because tough cash lenders aren't needed to comply with the exact same regulations that traditional lending institutions are.

While difficult money finances come with advantages, a consumer needs to additionally think about the dangers. Among them are: Difficult money loan providers generally charge a higher passion price since they're presuming even more danger than a get redirected here traditional lender would certainly.

Not known Factual Statements About Hard Money Atlanta

Every one of that amounts to indicate that a hard money loan can be a costly way to borrow cash. hard money atlanta. Making a decision whether to obtain a difficult money financing depends in huge part on your circumstance. All the same, make sure you consider the dangers and the costs prior to you join the populated line for a tough money loan.You absolutely do not intend to lose the car loan's collateral due to the fact that you weren't able to keep up with the regular monthly settlements. Along with shedding the property you advance as collateral, failing on a tough cash loan can result in major credit report damage. Both of these outcomes will leave you worse off financially than you remained in the very first placeand may make it a lot harder to obtain again.

Not known Facts About Hard Money Atlanta

It is very important to consider aspects such as the lender's online reputation and also interest prices. You may ask a trusted real estate agent or a fellow home flipper for referrals. When you have actually nailed down the right tough money lending click reference institution, be prepared to: Generate the down repayment, which usually is heftier than the deposit for a conventional home loan Collect the required documentation, such as proof of revenue Potentially work with an attorney to discuss the regards to the financing after you've been authorized Draw up a strategy for settling the loan Just as with any loan, review the advantages and disadvantages of a tough money finance before you dedicate to loaning.Despite what sort of finance you pick, it's most likely an excellent suggestion to inspect your cost-free credit rating and also free credit history report with Experian to see where your funds stand.

When you hear words "hard money financing" explanation (or "personal cash lending") what's the initial point that experiences your mind? Shady-looking lending institutions that perform their organization in dark alleys and fee overpriced rate of interest? In previous years, some poor apples stained the tough cash providing market when a couple of aggressive lenders were attempting to "loan-to-own", providing really dangerous car loans to debtors using property as collateral as well as planning to foreclose on the properties.

Report this wiki page